Interest is a way of generating money from a bank or other financial institution by lending it to somebody. In other words, we can also say that interest is where the lender takes a percentage of an amount as a return for lending it to someone. On the other hand, a dividend is an amount of money paid by a company to its shareholders, usually as part of their profits or in return for owning shares in the company. This was the brief intro of these two terms. Now to understand the complete difference between interest and dividend read out the following sub-topics of this blog.

You Can Also Read: Difference Between Share and Stock

What Is Interest?

Interest usually refers to the amount of money that is paid by a borrower to a lender as compensation for the use of the lender’s money. The amount of interest that is charged depends on the amount of money borrowed, the length of time that the money is borrowed, and the rate of interest.

Interest can be charged on loans, credit cards, mortgages, and other types of debt. It can also be earned on savings accounts and investments. When interest is charged on a loan, it is usually expressed as a percentage of the total amount borrowed. This percentage is known as the interest rate. The interest rate can be fixed, which means that it does not change over the life of the loan, or it can be variable, which means that it can go up or down depending on economic conditions.

Interest can also be compound, which means that it is charged on both the principal (the original amount borrowed) and on the interest that has already been accrued. Moreover, interest is paid by companies to investors who have loaned them money, typically in the form of bonds. The amount of interest that is paid is typically fixed, and investors will receive periodic payments (usually semi-annual or annual) until the bond matures.

What Is Dividend?

On the other hand, a dividend refers to a distribution of a company’s earnings to its shareholders. This means that, when a company makes a profit, it can either reinvest that money back into the business or pay out some of it to shareholders in the form of dividends. Dividends are typically paid out quarterly, though some companies choose to pay them monthly or annually.

Additionally, dividends are paid out of a company’s after-tax profits. That means that the company has already paid taxes on its earnings before distributing dividends to shareholders. They are not tax-deductible for the company, but they may be taxable for shareholders depending on their tax bracket and whether the dividend is considered “qualified” or “ordinary.”

- Qualified dividends are those that meet certain criteria set by the IRS, such as being paid by U.S.-based companies or certain foreign companies. Such types of dividends are taxed at the lower capital gains tax rate

- Ordinary dividends are those that don’t meet the criteria to be considered qualified. Qualified dividends are taxed at the lower capital gains tax rate. These dividends are taxed at the higher ordinary income tax rate.

The amount of dividend paid per share may typically fluctuate based on the company’s performance, and investors will only receive payments if the company is profitable. Also, dividends are not guaranteed like interest payments are – if a company has a bad year, it may choose not to pay dividends at all.

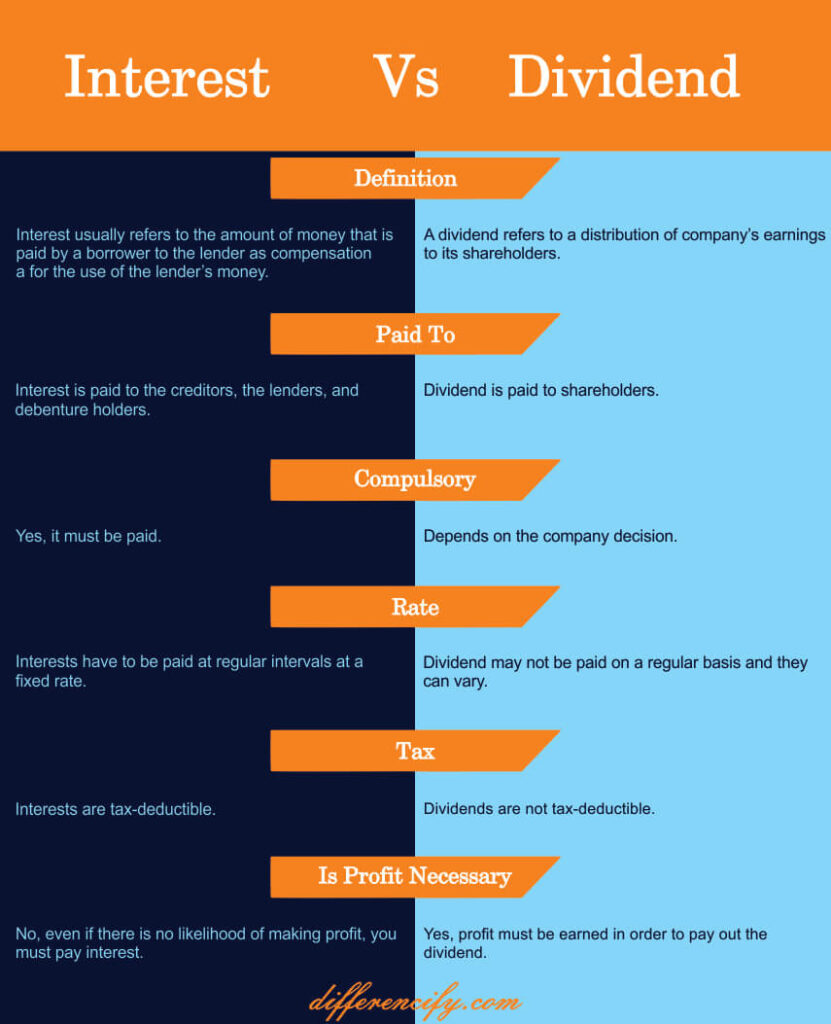

Interest Vs Dividend – Main Difference

The main difference between interest and dividend is that Interest is money that is paid by a borrower to a lender for the use of money that has been lent. The borrower pays interest as a way of compensating the lender for the opportunity cost of lending out the money. In other words, interest is the price of borrowing money. Dividends, on the other hand, are payments that are made by a company to its shareholders out of its profits. Dividends are typically paid out quarterly, and they can be in the form of cash or shares of stock.

Interest Vs Dividend(Comparison Table)

Seven Key Differences Between Interest And Dividend

- Interest refers to the sum paid for the usage of borrowed funds. On the other hand, a dividend is a portion of a company’s profit that is distributed to its true owners(shareholders), either in cash or in kind.

- Interest is paid to a lender, while dividends are paid to shareholders.

- While interest payments are typically made at regular intervals, dividends may be paid out more irregularly.

- Interest payments are generally fixed, while dividend payments may vary.

- The amount of interest paid is typically based on the amount of money borrowed. On the other hand, the amount of dividends paid is typically based on the company’s profitability.

- Interest is usually taxable, while dividends may be taxed at a lower rate.

- Finally, interest payments are typically made in cash. On the contrary, dividends may be paid in cash or in stock.

Conclusion

To sum up this blog, the key difference between interest and dividends is that interest is paid to a lender, while dividends are paid to shareholders. Interest payments are typically fixed, while dividend payments can vary. Both interest and dividends can be taxed. In short, interest is paid to those who lend money, while dividends are paid to shareholders.

3 Comments