There are many benefits to leasing a property, but sometimes there can be confusion as to what is the best option for your needs. A finance lease and operating lease are two different types of lease agreements that companies can use to acquire assets that they need to run their business, such as equipment or vehicles.

Both finance and operating leases can be either capital or operating, depending on the circumstances. So, in this article, we will get to understand the complete difference between a finance lease and an operating lease with the help of the following sub-topics.

What Is a Lease?

When you lease an asset, you essentially rent it from the owner for a set period of time. The lessor (the owner) is responsible for maintaining and insuring the property, while the lessee (the renter) is responsible for paying rent and using the property in a careful manner. There are two main types of leases: finance leases and operating leases.

You Can Also Read: Difference Between Direct and Indirect Expenses

What Is Finance Lease?

A finance lease is a type of leasing arrangement where the lessee (the party renting the asset) is responsible for the maintenance and upkeep of the leased asset, as well as any insurance and taxes associated with it. The lessor (the party owning the asset) is only responsible for providing the leased asset to the lessee. The lease term is typically longer than an operating lease, and at the end of the term, the lessee may have the option to purchase the leased asset from the lessor.

Finance leases are typically used for larger and more expensive assets such as vehicles, real state machinery, and other expensive equipment.

Advantages Of Finance Lease

- One advantage of a finance lease is that it can provide a way for a business to acquire an asset without having to come up with all of the upfront capital.

- Payments made under a finance lease are typically tax-deductible.

- Another benefit of a finance lease is the availability of various payback schemes that can be adjusted to your company’s cash flow.

- The main advantage of a finance lease for the lessee is that it offers an alternative to taking out a traditional bank loan. The payments are fixed, so there is no need to worry about fluctuating interest rates, and the terms of the lease can be tailored to suit your specific needs.

Disadvantages Of Finance Lease

There are some disadvantages to finance leases as well.

- One is that since the lessee is responsible for maintaining and insuring the leased asset, there is more risk involved than with an operating lease.

- If the leased asset is sold or otherwise disposed of before the end of the lease term, any outstanding balance on the lease must be paid in full.

- You will not own the asset at the end of the lease so you will have nothing to show for your payments if you decide to move on.

- Another downside of finance leasing is that the asset is not safeguarded if you or your company go bankrupt.

What Is an Operating Lease?

An operating lease is a contract between a lessor and lessee for the use of an asset, where the lessee is only responsible for paying for the use of the asset during the lease term. The lessor remains the owner of the asset and is responsible for all maintenance and repair costs. Operating leases are often used for equipment that has a short useful life or when the lessee does not want to own the asset outright.

Advantages Of Operating Lease

- One of the benefits of the operating lease is that you only need to lease the asset for as long as you need it, lowering the overall costs of owning, maintaining, and selling it when you no longer require it.

- There are usually no upfront payments in this form of contract, which allows you to have this equipment even if you do not have the necessary funds for the investment.

- Rental expenses are decreased since another party takes the residual value and receives tax benefits.

Disadvantages Of Operating Lease

- The disadvantage of an operating lease is that, depending on how long an asset is leased, the total cost may exceed the market value at the time the lease was initiated.

- The biggest downside of an operating lease is that there is no option to purchase. This suggests that once the rental period is complete, you will have to renegotiate it or, failing that, return it. Its use will be amortized, but not its purchase.

- Operating leases include the fact that the lessee does not have any ownership rights to the asset and may be required to pay higher monthly payments than if they had purchased the asset outright.

- Additionally, operating leases can be complex contracts that may be difficult to understand.

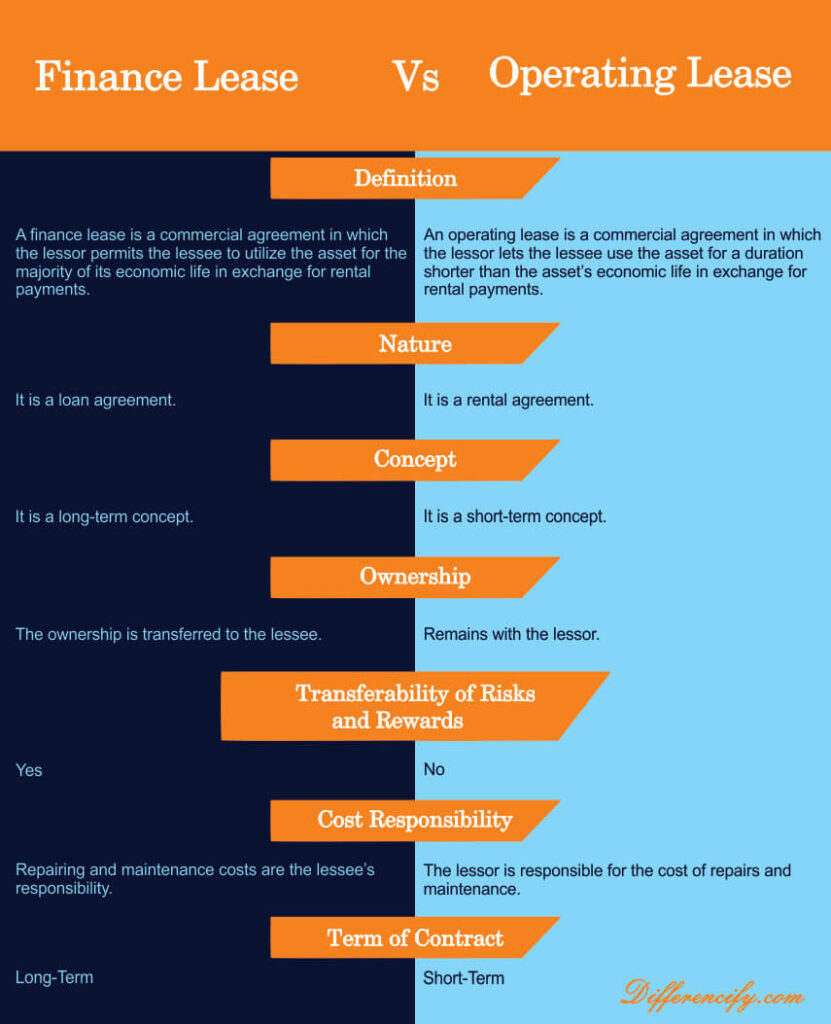

Comparison Table

Key Differences Between Finance And Operating Lease

The following points will help us understand the key differences between finance and operating lease.

- Lessee Accounting Treatment – Under a finance lease, the lessee recognizes the leased asset as an asset on their balance sheet. The lease payments are then treated as loan repayments and are recorded as interest expense and principal repayments on the income statement. Operating leases, on the other hand, do not require the lessee to record the leased asset on their balance sheet. The lease payments are simply recorded as rental expenses on the income statement.

- Lessor Accounting Treatment – Under a finance lease, the lessor recognizes the leased asset and the related lease receivable on their balance sheet. The lease payments are then treated as revenue on the income statement. Operating leases, however, do not require the lessor to record the leased asset or receivable on their balance sheet. The lease payments are simply recorded as rental income on the income statement.

- Risk And Rewards – Finance leases transfer most of the risks and rewards associated with owning an asset to the lessee. Operating leases, however, leave these risks and rewards with the lessor.

- Property Taxes – With a finance lease, the lessee is typically responsible for paying any property taxes associated with the leased asset. Operating leases generally do not require the lessee to pay property taxes.

- Maintenance And Repairs – Under a finance lease, the lessee is typically responsible for maintaining and repairing the leased asset. Operating leases, however, often include provisions that require the lessor to cover these costs.

- Insurance – Finance leases typically require the lessee to insure the leased asset. Operating leases, on the other hand, generally allow the lessor to insure the asset.

- Term of lease – Finance leases are typically longer in term than operating leases. This is because finance leases transfer ownership of the asset to the lessee at the end of the lease term while operating leases do not.

Conclusion

So, to wrap up this article, we can say that there are two types of leases that a business can enter into – finance leases and operating leases. Both have their own advantages and disadvantages, so it’s important to understand the difference between the two before making a decision.

Finance leases offer businesses the opportunity to own the asset at the end of the lease term. On the other hand, operating leases do not offer this opportunity. However, finance leases also tend to be more expensive in the short term, so they may not always be the best option for businesses on a tight budget.

Operating leases, are generally cheaper in the short term and can offer more flexibility to businesses since they don’t have to commit to owning the asset long-term.

Ultimately, it’s up to each business to decide which type of lease is best for them based on their individual needs and circumstances.