Difference Between Interim And Final Dividend(With Table)

There are two different types of dividends that a firm can choose to pay, i.e. interim dividend and final dividend. Interim dividends are usually paid out on a quarterly basis and are typically not the same amount as the final dividend which is normally paid out at year-end. Normally, firms will announce their interim dividends but not their final dividends until later in the year. This was a brief introduction to the interim and final dividend. To understand the complete difference between them, scan the following topics.

What is Dividend?

According to Investopedia, “a dividend is a distribution of a company’s earnings to its shareholders that is established by the board of directors of the company”.

What Is an Interim Dividend?

An interim dividend is a dividend that is paid out by a company before its financial year-end. This type of dividend is usually paid out of the company’s profits from the previous financial year. The board of directors declares the interim dividend, but it is subject to shareholder approval.

Two Advantages Of Interim Dividend

There are many advantages of interim dividends, but here we have mentioned two of the main ones.

- The main reason why companies choose to pay an interim dividend is to give their shareholders a return on their investment sooner rather than later. This can be beneficial for both the shareholders and the company itself, as it can help to boost morale and confidence in the business.

- Another advantage of paying an interim dividend is that it can help to reduce the amount of tax that the company has to pay. This is because dividends are taxed at a lower rate than other forms of income.

Two Disadvantages Of Interim Dividend

However, there are some drawbacks to paying an interim dividend. Two of them are given as follows.

- One of these is that it can signal to investors that the company is not doing as well as it could be. This could lead to some shareholders selling their shares, which would in turn push down the share price.

- Another downside is that if the company does not make enough profit in the second half of its financial year, then it may not be able to afford to pay out a final dividend at all. This could leave shareholders feeling short-changed.

What Is the Final Dividend?

A final dividend refers to the distribution of earnings to shareholders that are declared and paid by a company at the end of its fiscal year. A final dividend is in addition to any periodic dividends that the company may have declared during the year.

A company’s board of directors has the discretion to declare a final dividend, and they will usually do so after taking into account the company’s financial performance for the year as well as its expected cash flow and profitability in the future. If a company has performed well and is expected to continue to do so, the board may declare a larger final dividend than in previous years. Conversely, if a company’s prospects are not as bright, the board may elect to reduce or eliminate the final dividend.

Additionally, the payment of a final dividend is an important event for shareholders, as it represents a return on their investment in the company. For investors who hold shares for the long term, the payment of regular dividends (including final dividends) can provide them with a source of income, even if the share price remains stagnant.

Interim Vs Final Dividend – Main Difference

The main difference between interim and final dividends is that interim dividends are paid before the company’s financial year-end, while final dividends are paid after the company’s financial year-end.

Interim dividends are usually smaller in amount than final dividends. This is because companies usually have a better idea of their profits for the full year after they have completed their financial year-end.

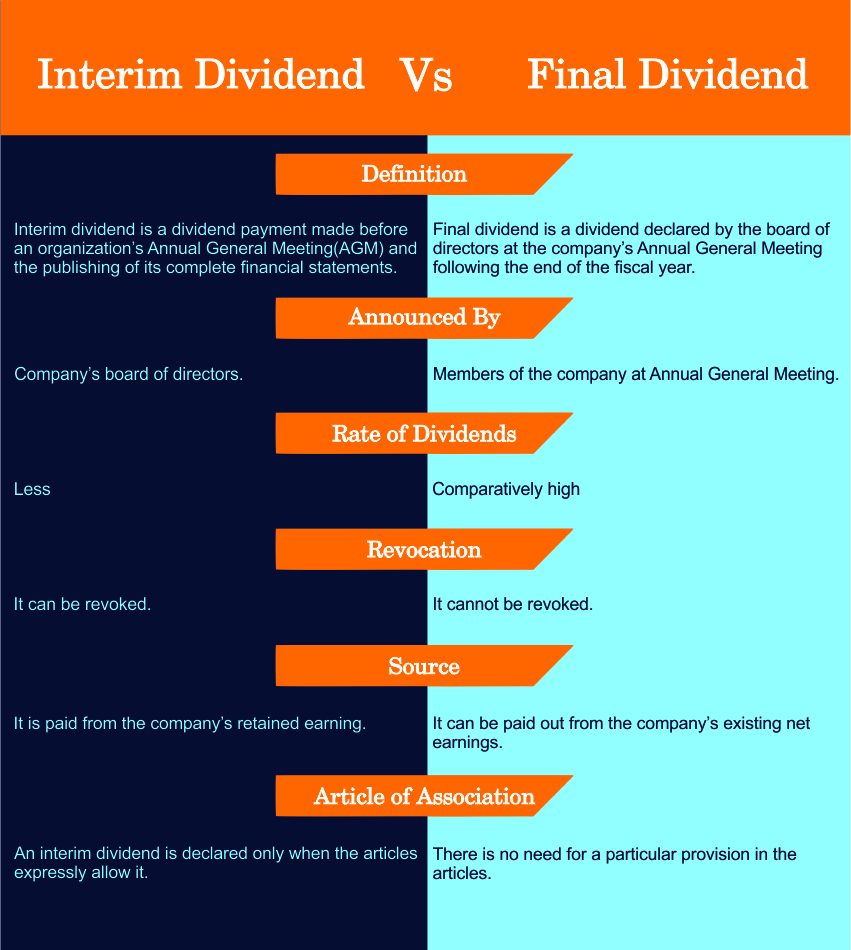

Interim vs Final Dividend(Comparison Table)

Six Key Differences Between Interim And Final Dividend

Both types of dividends represent a distribution of profits to shareholders, there are some key differences between the two. Here we have mentioned six of the key differences between them – given as follows.

- Timing – Interim dividends are typically paid out during the first half of the year, while final dividends are paid out during the second half.

- Amount – Interim dividends tend to be smaller in amount than final dividends.

- Frequency – Interim dividends are usually paid on a quarterly basis. On the other hand, final dividends are typically paid on an annual basis.

- Taxation – Interim dividends are taxed at the current year’s tax rate. On the contrary, final dividends are taxed at the tax rate in effect for the year in which they are received.

- Record Date – The record date for interim dividends is typically set at the time of payment. On the other hand, the record date for final dividends is set at the end of the financial year.

- Cancellation – The interim dividend can be canceled with the approval of all shareholders. On the other hand, the final payout cannot be overturned once issued.

Conclusion

So, from the above discussions, it is clear that there are several key differences between interim and final dividend. However, both types of dividends represent a return on investment for shareholders and help to increase shareholder value.

The main difference between interim and final dividend is that interim dividend is paid before the end of the financial year while the final dividend is paid after the end of the financial year. An interim dividend is declared by the directors of a company when they feel that the company has performed well and has sufficient profits to distribute among shareholders. On the other hand, final dividends are declared after taking into account the performance of the company for the entire financial year.