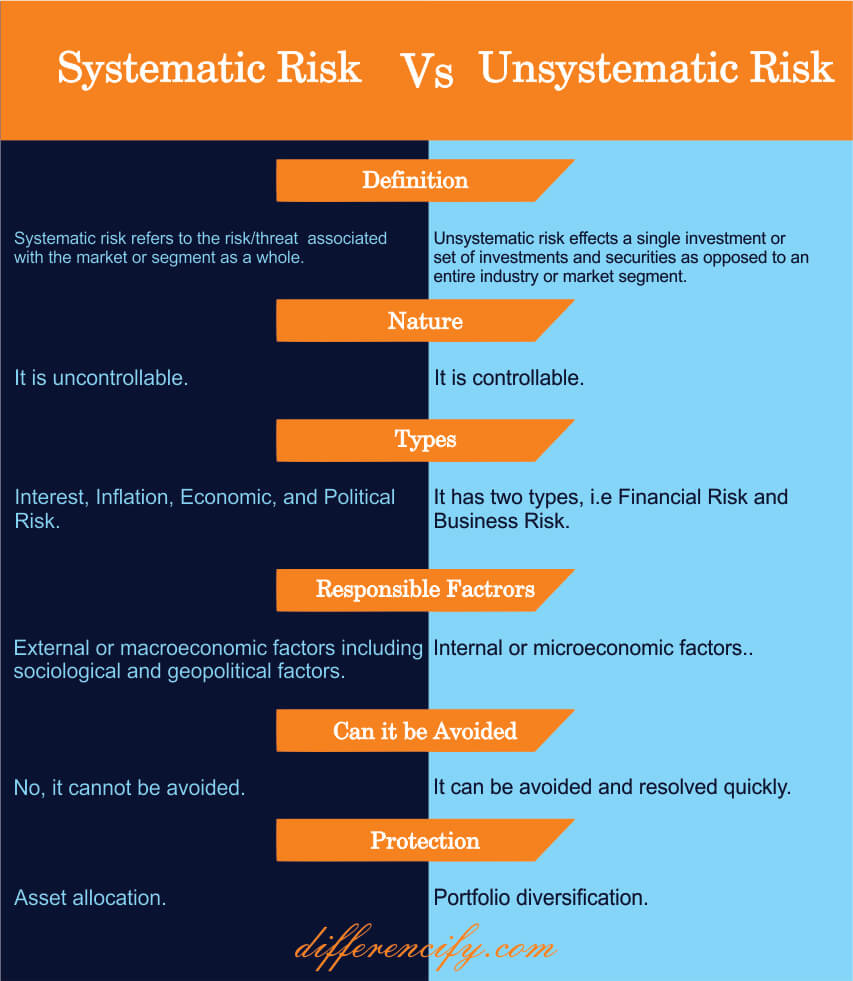

Difference Between Systematic and Unsystematic Risk(With Table)

Systematic risk is the financial risk that comes from an individual’s exposure to systematic market risks. These risks include changes in rates of inflation, interest rates, and similar macroeconomic variables. Unsystematic risk is the financial risk that comes from an individual’s exposure to specific company-specific or industry-specific variables. In this article, we will have a look at the core difference between systematic and unsystematic risk with the help of different topics and a table comparing them.

What is Systematic Risk?

Systematic risk refers to the risk that is inherent to the entire market or market segment. It cannot be diversified away. Systematic risk is also known as “market risk” or “volatility.” Systematic risk is one that affects all investments in a particular asset class to some degree.

In simple words, Systematic risk is the risk that is inherent to the entire market. It cannot be diversified away. Moreover, the factors that lead to systematic risk are largely out of the control of any one company.

Some examples of systematic risk include:

Interest Rate Risk – This is the risk that changes in interest rates will affect the value of your investments. When interest rates go up, the value of your bonds will usually go down.

Inflation Risk – This is the risk that the purchasing power of your money will decrease over time. As inflation goes up, the prices of goods and services also tend to increase, which means that your money can buy less.

Political Risk – This is the risk that political instability or a change in government could lead to a change in economic policies that could adversely affect your investments.

Economic Risk – This is the risk that an economic recession or another economic event could lead to a decrease in the value of your investments.

What is Unsystematic Risk?

Unsystematic risk is unique to a certain company or industry. Specific risk and diversifiable risk are other terms for unsystematic risk. It’s unique to a particular company or industry and can be diversified away by investing in multiple companies or industries. Diversification is the process of spreading your investment across different asset classes in order to reduce your exposure to unsystematic risk.

Additionally, the factors that cause unsystematic risk are usually unpredictable and out of your control. For example, a company might experience unsystematic risk if there’s a fire at its factory. This event is out of the company’s control and would likely have a negative impact on its stock price. Unsystematic risk can be minimized by diversifying your portfolio across multiple asset classes. This way, if one asset class experiences a loss, it’s likely that another asset class will offset the loss.

One example of unsystematic risk is the risk that a company will go bankrupt. This is specific to that company and not to the market as a whole. The two categories of unsystematic risk are given below :

Company-Specific Risk – This type of risk is unique to a particular company and can be diversified away by investing in a variety of different companies. Examples include the risk of bankruptcy, poor management, or poor product quality.

Financial Risk – This type of risk is specific to the financial industry and can be diversified away by investing in a variety of different financial instruments. Examples include interest rate risk, currency risk, and credit risk.

Comparison Table

Key Difference Between Systematic and Unsystematic Risk

- Systematic risk refers to the fluctuations in returns of an investment that are caused by factors that affect the entire market. Unsystematic risk, on the other hand, is specific to a particular company or industry and can be diversified away.

- Systematic risk is also known as market risk, whereas unsystematic risk is also called specific risk or diversifiable risk.

- The degree of systematic risk is measured by beta, while there is no measure for unsystematic risk.

- Systematic risk can be significantly reduced by employing tactics such as hedging and asset allocation. Unsystematic risk, on the other hand, can be reduced by portfolio diversification.

- Systematic risk affects all investments in the market while unsystematic risk affects only a particular investment.

- Investors are compensated for bearing systematic risk through higher expected returns. On the other hand, they are not compensated for bearing unsystematic risk.

- While analyzing an investment, investors must consider both systematic and unsystematic risk.

- Systematic risk is an important factor to consider in portfolio management while the unsystematic risk is not as important.

Conclusion

In conclusion, systematic risk is the type of risk that is inherent to the entire market or economy, while the unsystematic risk is specific to individual companies. Systematic risk can be significantly reduced by employing tactics such as hedging and asset allocation. Unsystematic risk, on the other hand, can be reduced by portfolio diversification.

Reference Blogs: