Are you trying to manage your business expenditures? Do you feel like you’re getting a less-than-ideal return on investment from your budgeting? In this article, I will walk you through the difference between fixed budget and flexible budget. Fixed budget and flexible budget are two different types of budgets. A fixed budget is a project’s cost that is set before the research starts, but a flexible budget is one that changes as per the requirement. In order to overview the difference, let’s first have a look at the following table comparing both fixed vs flexible budget in a side-by-side way.

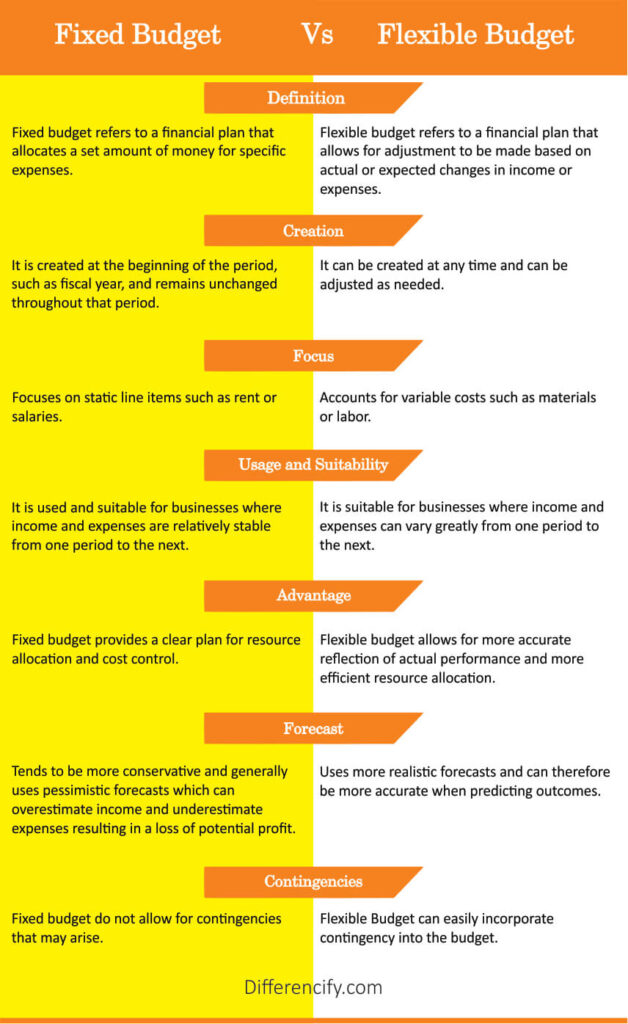

Fixed Vs Flexible Budget (Comparison Chart)

| Fixed Budget | Flexible Budget |

|---|---|

| A fixed budget refers to a financial plan that allocates a set amount of money for specific expenses. | A flexible budget refers to a financial plan that allows for adjustments to be made based on actual or expected changes in income or expenses. |

| A fixed budget can be created at the beginning of a period, such as the fiscal year, and remains unchanged throughout that period. | A flexible budget can be created at any time and can be adjusted as needed. |

| It focuses on static line items such as rent or salaries. | It accounts for variable costs such as materials or labor. |

| A fixed budget is used and suitable for businesses where income and expenses are relatively stable from one period to the next. | A flexible budget is suitable for businesses where income and expenses can vary greatly from one period to the next. |

| The best advantage of a fixed budget is that it provides a clear plan for resource allocation and cost control. | The best advantage of a flexible budget is that it allows for a more accurate reflection of actual performance and more efficient resource allocation. |

| It tends to be more conservative and generally uses pessimistic forecasts which can overestimate income and underestimate expenses resulting in a loss of potential profit. | It uses more realistic forecasts and can therefore be more accurate when predicting outcomes. |

| Fixed budgets do not allow for contingencies that may arise. | A flexible budget can easily incorporate contingency into the budget. |

- Difference Between Fixed and Flexible Exchange Rate

- Difference Between NOPAT and Net Income

- Difference Between Planning and Strategy

What Is a Budget?

A budget is a tool that helps you track your income and expenses so you can make informed financial decisions. It lets you know how much money is coming in and where it’s going. A budget encourages you to save for major purchases, like a home or vehicle. And if you don’t have enough savings to cover the purchase, your budget can help you find other ways to make up the difference.

What Is a Fixed Budget?

A fixed budget is a type of budget that does not change based on sales or other factors. This type of budget is typically used in businesses where costs are relatively stable and predictable. A fixed budget can be helpful in planning and controlling expenses, but it can also be inflexible if costs unexpectedly increase.

Pros of Fixed Budget

- The main benefit of using a fixed budget is that it allows you to accurately plan your expenses and get a bird’s-eye view of how much money will be available throughout the year. You’ll know what your income and expenses are going to be at all times and this can help you make better decisions. In addition, you’ll know exactly how much money you have to work with if you want to save up for a large purchase or invest in stocks and bonds.

- This budgeting method is also useful if your income is less predictable than if it remained the same every month.

- It provides a clear and consistent financial plan for the entire budget period.

- Also, it helps to control spending by limiting expenditures to a predetermined amount.

- Finally, a Fixed budget is easier to prepare and implement as it involves fewer variables and less complexity.

Cons of Fixed Budget

- A fixed budget may not be adaptable to changes in income or expenses that may occur during the budget period.

- Second, it does not allow for contingency planning, making it difficult to adjust to unexpected events or emergencies.

- And, it may not allow for investments in new opportunities or initiatives that arise during the budget period, potentially hindering growth or innovation.

What Is a Flexible Budget?

A flexible budget is a type of budget that can be adjusted based on sales or other factors. This type of budget is typically used in businesses where costs can vary significantly from month to month. A flexible budget can be helpful in managing expenses, but it can also be more difficult to track and control than a fixed budget.

Many companies choose to use a “flexible” budget plan that adjusts based on sales and other factors. This allows them to adjust quickly if they need to expand or contract their operations without having to wait until the next fiscal year begins. For example, a business might decide it needs more employees or equipment if demand increases. In this case, the company could use its flexible budget plan to increase spending on labor and equipment immediately instead of waiting for the next fiscal year.

Pros of Flexible Budget

- A flexible budget can adjust to changes in income or expenses that may occur during the budget period.

- It allows for contingency planning, making it easier to adjust to unexpected events or emergencies.

- It provides a more realistic financial plan as it considers varying levels of income and expenses.

- Finally, a flexible budget can allow for investments in new opportunities or initiatives that arise during the budget period, potentially promoting growth or innovation.

Cons of Flexible Budget

- A flexible budget is more complex and time-consuming to prepare and implement due to the consideration of multiple variables and potential adjustments.

- It may be subject to manipulation or inaccuracies if not managed properly, leading to potential financial risks.

- It may require more frequent monitoring and adjustment to ensure accuracy and effectiveness, potentially creating a heavier workload for budget managers.

Fixed and Flexible Budget – Main Difference

When it comes to budgeting, there are two main types of approaches that businesses take – fixed budgets and flexible budgets. So, what’s the difference between the two?

Fixed budgets are just that – fixed. This means that you set a budget for a specific period of time, and no matter what happens during that period, you don’t change the budget. This can be good for businesses that have predictable income and expenses.

Flexible budgets, on the other hand, are adjustable. This means that you can change the budget as needed based on actual income and expenses. This can be good for businesses with variable income and expenses.

Key Differences Between Fixed And Flexible Budget

There are a few key differences between fixed and flexible budgets that you should be aware of. A few of them are as follows;

- A fixed budget is a financial plan that allocates a set amount of money for specific expenses. A flexible budget, on the other hand, is a financial plan that allows for adjustments to be made based on actual or expected changes in income or expenses.

- Secondly, a fixed budget is typically created at the beginning of a period, such as a fiscal year, and remains unchanged throughout that period. A flexible budget can be created at any time and can be adjusted as needed.

- If we talk about focus, a fixed budget focuses on static line items, such as rent or salaries. A flexible budget, however, can account for variable costs, such as materials or labor.

The following table shows a side-by-side comparison between fixed vs flexible budget.

Conclusion

So in conclusion, both types of budgets have their pros and cons, so it’s important to weigh them carefully before deciding which one is right for you. As previously indicated, both budget categories are significant in particular contexts. Making better financial decisions, planning your expenses, and keeping tabs on them all require a budget. It aids in earnings tracking and keeps us prepared for eventualities.

2 Comments