When it comes to financial management, tax and audit are two crucial aspects that every business owner must be aware of. While both of these terms relate to the management of finances, they have different roles and functions. Understanding the differences between tax and audit is important for any business owner, especially when it comes to the preparation and filing of tax returns. So, in this article, we will get to understand the difference between them as well as the difference between tax and audit salary.

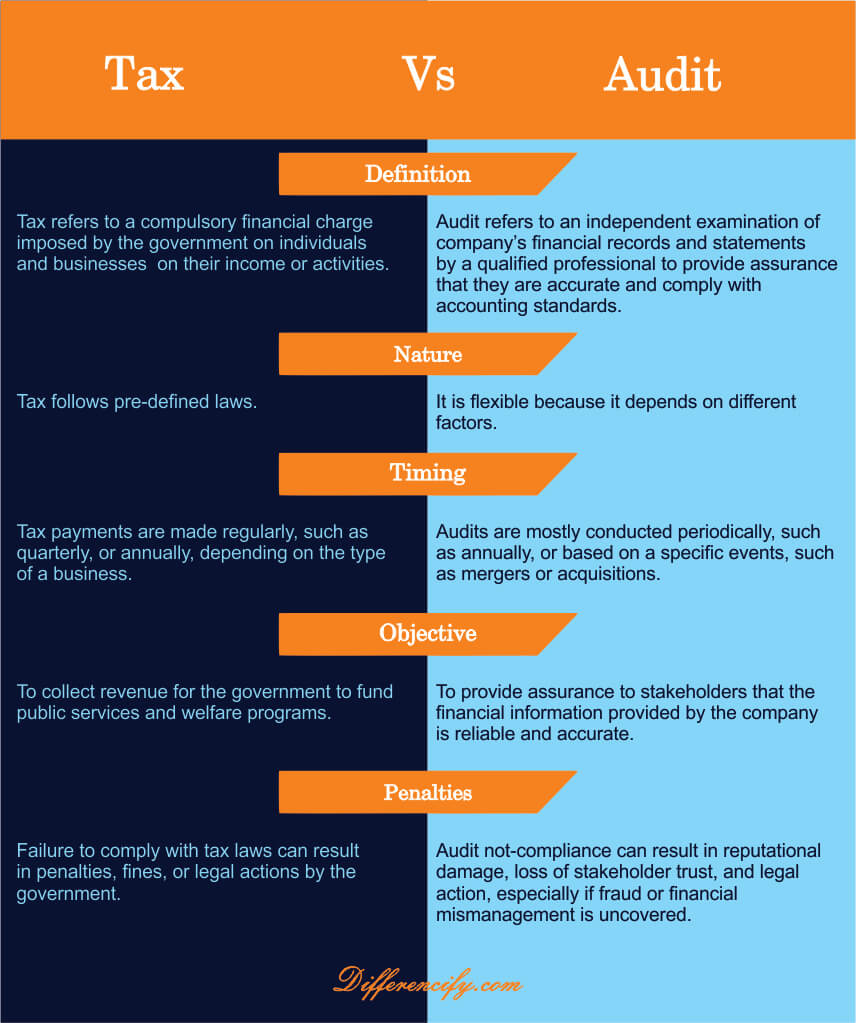

Tax Vs Audit (Comparison Table)

| Tax | Audit |

|---|---|

| Tax refers to a compulsory financial charge imposed by the government on individuals and businesses based on their income or activities. | The audit is an independent examination of a company’s financial records and statements by a qualified professional to provide assurance that they are accurate and comply with accounting standards. |

| The tax follows pre-defined laws. | It is flexible because it depends on different factors. |

| Tax payments are made on a regular basis, such as quarterly or annually, depending on the type of tax. | Audits are conducted periodically, such as annually, or based on specific events, such as mergers and acquisitions. |

| The main objective of the tax is to collect revenue for the government to fund public services and welfare programs. | The main objective of an audit is to provide assurance to stakeholders that the financial information presented by the company is reliable and accurate, and to identify risks and opportunities for financial management improvement |

| Failure to comply with tax laws can result in penalties, fines, or legal action by the government. | Audit non-compliance can result in reputational damage, loss of stakeholder trust, and legal action, especially if fraud or financial mismanagement is uncovered. |

| Tax compliance covers the reporting and payment of taxes based on income or activities, including income tax, sales tax, payroll tax, and property tax. | The audit covers the financial records and statements of a company, including the balance sheet, income statement, cash flow statement, and notes to the financial statements, as well as the assessment of internal controls. |

| It is mandatory for individuals and businesses to comply with tax laws and regulations. | It can be mandatory for companies based on their size, industry, and ownership structure, or voluntary if a company wants to improve its financial management and provide assurance to stakeholders. |

What is Tax?

Tax refers to the compulsory financial charge that every individual or business must pay to the government. The money collected from taxes is used to fund government programs and services such as healthcare, education, defense, and infrastructure development. Taxes can be levied on income, property, goods and services, and capital gains. Different tax systems exist in different countries, and each system has its own set of rules and regulations.

The payment of taxes is mandatory, and failure to pay taxes can lead to severe consequences, including fines, penalties, and even imprisonment. Business owners must ensure that they are aware of the tax laws in their country and that they are compliant with them.

What is Audit?

Audit refers to the independent examination of a company’s financial records and statements to determine their accuracy and completeness. An audit can be conducted by an external auditor or an internal auditor, depending on the size and complexity of the company. The purpose of an audit is to provide assurance to stakeholders that the financial information presented by the company is reliable and accurate.

Audits are usually conducted annually and cover various areas, including financial statements, internal controls, and compliance with laws and regulations. The auditor will examine the financial records, interview employees, and review documents to ensure that the financial information presented by the company is accurate and complies with the applicable accounting standards.

Key Differences Between Tax and Audit

1. Purpose: The main difference between tax and audit is their purpose. Tax is a financial charge that businesses must pay to the government. An audit, on the other hand, is an independent examination of a company’s financial records to provide assurance to stakeholders that the financial information presented by the company is reliable and accurate.

The purpose of the tax is to raise revenue for the government to fund public services and programs. On the other hand, the purpose of an audit is to provide stakeholders with assurance that the financial information presented by the company is accurate and reliable.

2. Voluntary vs. Mandatory: Another significant difference between tax and audit is that tax payment is mandatory, while an audit is not. Every business owner must pay taxes to the government, regardless of the size or type of the business. Failure to pay taxes can lead to severe consequences, including fines, penalties, and imprisonment.

On the other hand, an audit is voluntary and depends on the company’s size, complexity, and stakeholders’ requirements. Large corporations are required by law to conduct an audit annually, but small businesses may choose to conduct an audit voluntarily to improve their financial management and provide assurance to stakeholders.

3. Timing: Tax and audit also differ in terms of timing. Tax payment is usually done annually or quarterly, depending on the tax system in the country. Business owners must ensure that they comply with the tax laws in their country and pay taxes on time to avoid penalties and fines.

An audit, on the other hand, is usually conducted annually, but it can be done at any time, depending on the company’s needs and stakeholders’ requirements. An audit can be conducted before or after the tax payment, and it does not affect the tax liability of the business.

4. Scope: Tax and audit also differ in terms of their scope. The tax covers various areas, including income, property, goods and services, and capital gains. Business owners must ensure that they comply with the tax laws in their country and pay the correct amount of tax based on their income and other financial activities.

An audit, on the other hand, covers the financial records and statements of a company, including the balance sheet, income statement, cash flow statement, and notes to the financial statements. The scope of an audit also includes assessing the internal controls of the company to ensure that they are adequate and effective.

The following table also shows the difference between tax and audit in a sequential manner.

You Can Also Read:

Tax Vs Audit Salary

Tax and audit salary are two different types of compensation paid to individuals in different professions.

The tax professionals, such as tax accountants and tax lawyers, are responsible for assisting individuals and businesses in complying with tax laws and regulations. They prepare tax returns, provide tax advice, and assist with tax planning. The salary of a tax professional can vary depending on their level of experience, education, and the location and size of the company they work for. According to Glassdoor, the average salary for a tax accountant in the United States is around $62,000 per year, while the average salary for a tax lawyer is around $121,000 per year.

Audit professionals, on the other hand, are responsible for reviewing and examining a company’s financial records and statements to ensure their accuracy and compliance with accounting standards. They assess internal controls, identify risks and opportunities for improvement, and provide recommendations for financial management. The salary of an audit professional can also vary depending on their level of experience, education, and the location and size of the company they work for. According to Glassdoor, the average salary for an auditor in the United States is around $66,000 per year.

In summary, tax and audit salary are two different types of compensation paid to professionals in different professions. Tax professionals assist individuals and businesses in complying with tax laws and regulations, while audit professionals review and examine a company’s financial records and statements to ensure their accuracy and compliance with accounting standards. The salary of these professionals can vary depending on various factors, such as experience, education, location, and the size of the company they work for.

Conclusion

So, to wrap up this article, we can say that tax and audit are two important aspects of financial management that every business owner must be aware of. While tax is a compulsory financial charge that businesses must pay to the government, an audit is an independent examination of a company’s financial records to provide assurance to stakeholders that the financial information presented by the company is reliable and accurate.

The key differences between tax and audit include their purpose, voluntary vs. mandatory, timing, and scope. Business owners must ensure that they comply with the tax laws in their country and conduct an audit if required by law or voluntarily to improve their financial management and provide assurance to stakeholders.

2 Comments