When people think about insolvency and bankruptcy, they often think they’re the same thing. However, there are some significant distinctions between these two terminologies. Insolvency is the financial condition/status of being unable to pay one’s debts; unable to meet financial obligations. Bankruptcy is a legal status that involves the termination of a person’s (natural or juristic) right to organize or administer a business under the law and may lead to liquidation.

For example, if you declare bankruptcy, then certain debts or liabilities become discharged or canceled. On the other hand, in an insolvency situation, you might be able to negotiate a new payment schedule with your creditors if your assets exceed your liabilities. In this article, we will have a look at the core difference between insolvency and bankruptcy.

You Can Also Read: Difference Between Bankruptcy and Liquidation

What is Insolvency?

Insolvency is a financial state where an individual or organization is unable to pay off its debts. This can be due to a variety of reasons, such as poor financial planning, unexpected expenses, or a change in circumstances. When an individual or organization undergoes insolvency, they are said to be “insolvent.”

In the case of a company, insolvency may also refer to the inability of the company to continue operating as a going concern. This usually happens when the company is unable to pay its debts as they come due. If a company is insolvent, it may be forced to liquidate its assets in order to pay off its debts.

One of two things can cause a company to go bankrupt, or both at once are:

- Cash Flow Insolvency – This is when a company does not have enough cash to meet its short-term obligations. This can happen for a number of reasons, such as poor sales, high inventory levels, or late payments from customers.

- Balance sheet insolvency – This is when a company’s liabilities exceed its assets. This can happen for a number of reasons, such as high levels of debt, low levels of equity, or negative intangible assets.

What is Bankruptcy?

Bankruptcy, on the other hand, is a legal process that allows an individual or organization to have their debts forgiven. This is typically done by liquidating assets and using the proceeds to pay off creditors. Once an individual or organization has been declared bankrupt, they are no longer legally obligated to repay their debts.

There are several different types of bankruptcies, but the most common is Chapter 7 bankruptcy. In a Chapter 7 bankruptcy, you liquidate your assets to pay off your debts. You may also be able to keep some of your assets, such as your home and car if they are exempt from the bankruptcy process.

When should I apply for bankruptcy?

This is a challenging topic to answer because there are numerous variables to consider. You should speak with a bankruptcy attorney to get specific advice for your situation. Some general things to consider include:

- Whether you can afford to repay your debts

- Secondly, whether you are facing foreclosure or repossession

- Whether you are being harassed by creditors

- Whether you have assets that could be sold to pay off your debts

Keep in mind that filing for bankruptcy will have a negative impact on your credit score and make it difficult to obtain new credit in the future. You should only consider this option if you have no other way to repay your debts.

How to Apply For Bankruptcy – Five Steps

Once you have decided to file for bankruptcy, there are a few steps you need to take:

- Get credit counseling from an approved provider. This is a required step in the bankruptcy procedure. You must receive credit counseling within six months of filing for bankruptcy.

- Take a court-approved personal financial management course. This course must be completed before you can receive a discharge in your bankruptcy case.

- File a petition in your district’s bankruptcy court. You will need to include all of your creditors in your petition, as well as a list of all of your assets and liabilities.

- Attend a meeting of creditors. This meeting is required by law and gives your creditors an opportunity to object to the discharge of your debts in bankruptcy.

- Finally, receive your discharge. Once you have completed the bankruptcy process, you will be issued a discharge of your debts. This means that you will no longer be legally obligated to pay your creditors.

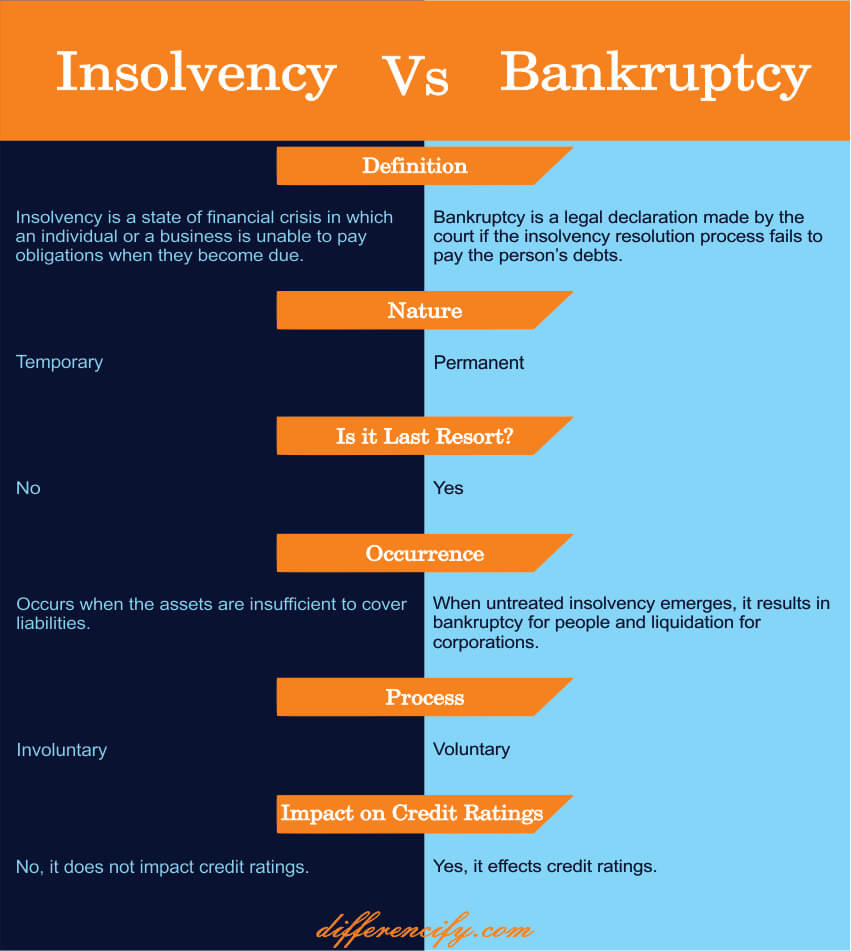

Insolvency Vs Bankruptcy(Comparison Table)

Key Differences Between Insolvency and Bankruptcy

It is important to understand the core differences between insolvency and bankruptcy.

- Insolvency means that you are unable to pay your debts as they come due. On the other hand, bankruptcy is a legal process that allows you to reorganize your finances and get rid of some of your debt.

- Insolvency is a financial condition while bankruptcy is a legal status.

- Bankruptcy is the last option; insolvency is not.

- Insolvency occurs when an individual or company is unable to pay its debts. On the other hand, bankruptcy occurs when an individual or company is declared legally unable to repay its debts.

- An insolvent person can continue to operate their business while a bankrupt person cannot.

- Creditors have more power in insolvency than they do in bankruptcy.

- In insolvency, the debtor usually has some say in the process while in bankruptcy, the debtor has no say and is subject to the decisions of the trustee and creditors.

- The cost of declaring insolvency is usually less than the cost of declaring bankruptcy.

Preventative Measures to Avoid Bankruptcy and Insolvency

There are a number of things that individuals and businesses can do to prevent themselves from becoming insolvent or bankrupt.

- The most important thing is to ensure that you have accurate financial records and that you keep on top of your finances. This means knowing exactly what money is coming in and going out, and keeping track of all debts and liabilities.

- If you are struggling to keep on top of your finances, it is important to seek professional help as soon as possible. There are many organizations that can offer advice and support, such as Citizens Advice or the Money Advice Service.

- It is also important to try to minimize your debts, and to only borrow money when you are confident that you will be able to repay it. If you are struggling with debt, there are many organizations that can offer advice and support, such as StepChange or National Debtline.

- Finally, if you are facing insolvency or bankruptcy, it is important to get professional advice as soon as possible. There are many organizations that can offer advice and support, such as the Insolvency Service or National Bankruptcy Information Line.

Conclusion

There are a few key differences between insolvency and bankruptcy that you should be aware of. Insolvency is when you are unable to pay your debts, while bankruptcy is when you are declared legally bankrupt by a court. Bankruptcy will stay on your credit report for seven years, while insolvency will only stay on your report for six months. Finally, if you file for bankruptcy, you may lose some of your assets, whereas, with insolvency, you will not lose any assets.

2 Comments