In the trading and investing world, the terms ‘bull’ and ‘bear’ market are very commonly used to refer to the market’s situation over a period of time. Both these terminologies describe whether the stock markets are appreciating or depreciating in their value. In this article, we will get to understand the basics of the bull and bear market, their key differences, investing strategies, key indicators for both markets, and a chart comparing both bull vs market in in-depth.

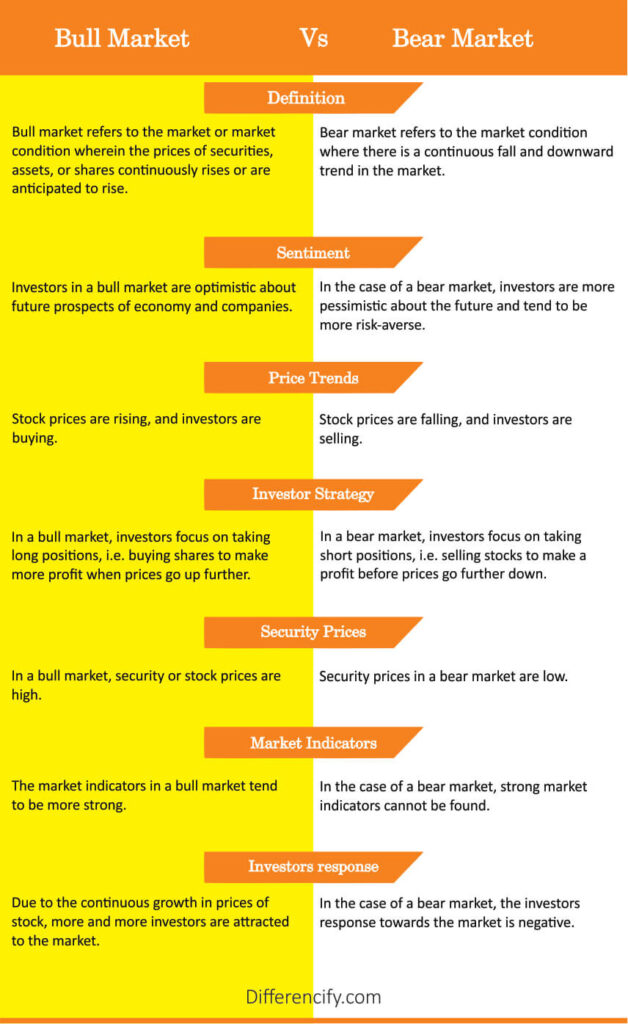

Bull Vs Bear Market (Comparison Table)

| Bull Market | Bear Market |

|---|---|

| Bull market refers to the market or market condition wherein the prices of securities, assets, or shares continuously rise or are anticipated to rise. | A bear market refers to a market condition where there is a continuous fall and downward trend in the market. |

| Investors in a bull market are optimistic about future prospects of the economy and companies | In the case of a bear market, investors are more pessimistic about the future and tend to be more risk-averse |

| In a bull market, stock prices are rising, and investors are buying. | In a bear market, stock prices are falling, and investors are selling |

| Investors in a bull market focus on taking long positions and buying shares to make more profit when prices go up further. | In a bear market, investors focus on taking short positions and selling stocks to make a profit before prices go further down. |

| The security or stock prices in a bull market are high. | The security or stock prices in a bear market are low. |

| The market indicators in a bull market tend to be more strong. | In the case of a bear market, strong market indicators cannot be found. |

| Due to the continuous growth in prices of stock, more investors are attracted to the market. | In the case of a bear market, investor response toward the market is negative |

What is a Bull Market?

A bull market is a period of sustained optimism and rising stock prices. This type of market typically lasts for an extended period, often several years. In other words, A bull market refers to a situation in the marketplace where the prices of the securities continuously rise or are anticipated to rise because of the favorable and improved internal circumstances of an organization.

This type of market encourages investors to purchase as the conditions of the stock market are commendatory. The best features of the bull market are investor confidence, positive expectations, high stock trading, and optimism in the market.

Moreover, the investors who invest in bull markets are called bulls, and the sentiments can be known as bullish.

What is a Bear Market?

On the other hand, a bear market is the opposite of a bull market, with falling stock prices and increased pessimism. In other words, a bear market refers to a market situation where there is a continuous fall and downward trend in the marketplace over a period of time. In such a type of market, the investor’s confidence declines due to pessimism i.e. because the value of the securities/assets either already decreases or is anticipated to decrease over a period of time.

Moreover, a bear market costs the stakeholders(investors) a lot of money because the value of the securities falls in the market and so, it badly hit the confidence and expectations of the investors.

Further, the investors who expect a decline in the securities prices are called bears, and the sentiments are known as bearish.

Key Differences Between Bull And Bear Market

While comparing the bull vs bear market, here we have included some of the key differences between them.

- Meaning – A bull market refers to the situation in the marketplace where the prices of the securities continuously rise or are anticipated to rise because of the favorable and improved internal circumstances of an organization. On the other hand, a bear market refers to a market situation where there is a continuous fall and downward trend in the marketplace over a period of time.

- Sentiment – Another difference between a bull and a bear market is the sentiment of investors. In a bull market, investors are typically optimistic about the future prospects of the economy and individual companies. In contrast, during a bear market, investors are more pessimistic about the future and tend to be more risk-averse.

- Price Trends – Another key difference is the direction of stock prices. In a bull market, stock prices are rising, and investors are buying. In contrast, in a bear market, stock prices are falling, and investors are selling.

The following table also compares both bull vs bear markets in a side-by-side manner.

Key Indicators of a Bull and Bear Market: How to Spot the Signs

The following three signs can let an investor know whether the market is doing well or not.

Market Momentum: One key indicator of a bull market is strong market momentum. This means that the market is consistently trending upward, with few or no significant dips. In contrast, during a bear market, the market tends to be more volatile, with more significant price swings.

Economic Growth: Another important indicator of a bull market is economic growth. In a growing economy, companies are more likely to experience increased profits, leading to higher stock prices. In contrast, during a bear market, economic growth may be stagnant or even negative, leading to lower stock prices.

Investor Sentiment: Investor sentiment is a critical indicator of both bull and bear markets. In a bull market, investors are generally optimistic about the future. On the other hand, in a bear market, they are more pessimistic. Monitoring investor sentiment can provide insight into how the market is likely to perform in the short term.

Investing Strategies for Bull and Bear Markets: Tips for Maximizing Returns

Following are the two most powerful ways and investing strategies that can help you maximize your returns on investments in a bull or a bear market.

Bull Market: During a bull market, investors should focus on growth stocks and sectors that are likely to benefit from economic expansion. This may include sectors such as technology, consumer discretionary, and healthcare. Investors should also consider using a buy-and-hold strategy, as short-term market swings are less likely to impact long-term growth prospects. However, it is important to keep an eye on market valuations and avoid becoming overexposed to a particular sector.

Bear Market: In a bear market, investors should focus on defensive stocks and sectors that are less sensitive to economic conditions. This may include sectors such as utilities, healthcare, and consumer staples. Investors should also consider using a defensive investing strategy, such as dollar-cost averaging or diversification, to minimize losses. It is also important to avoid panic selling and stay invested for the long term.

Navigating Volatility: How to Stay Calm and Invest Smartly in Bull and Bear Markets

Avoid Emotional Investing: One of the biggest mistakes investors make is letting emotions guide their investment decisions. Fear and greed can lead to irrational decision-making, which can result in significant losses. Instead, investors should focus on their long-term goals and avoid making impulsive decisions based on short-term market movements.

Stay Diversified: Diversification is a crucial element of any investment strategy, regardless of market conditions. By spreading investments across different asset classes, sectors, and geographic regions, investors can minimize the impact of market volatility and reduce risk.

Focus on Quality: In both bull and bear markets, investors should focus on quality investments that have a proven track record of success. This may include companies with strong financials, competitive advantages, and experienced management teams.

Conclusion

So to wrap up, we can say if the factors like global economic concerns, the national stock of the country, and the financial position of an organization go well, the investors will always have a positive response. The market is said to be a bull market if at least 20% or more growth is observed in the wholesale performance of the stock market.

2 Comments