When it comes to paying for goods and services, the two most popular names that come to mind are Visa and Mastercard. These two brands are recognized worldwide and have a huge customer base. However, not many people are aware of the differences between Visa and Mastercard, their pros and cons, and their security features. This article will explore these topics to help you make an informed decision about which card to use.

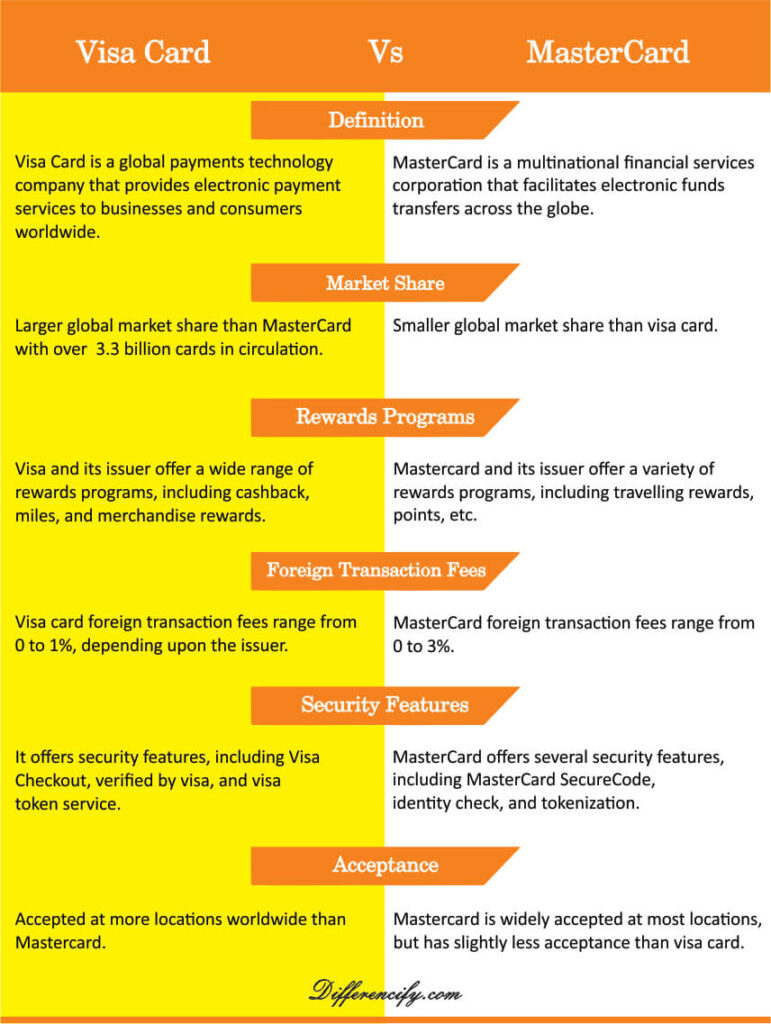

Visa Card Vs MasterCard (Comparison Chart)

| Visa Card | MasterCard |

|---|---|

| Visa Card is a global payments technology company that provides electronic payment services to businesses and consumers worldwide. | Mastercard is a multinational financial services corporation that facilitates electronic funds transfers across the globe. |

| Visa card has a larger global market share than MasterCard with over 3.3 billion cards in circulation. | MasterCard has a smaller global market share with over 2.6 billion cards in circulation. |

| Visa card and their issuers offer a wide range of rewards programs, including cash back, miles, and merchandise rewards. | Mastercard and its issuers offer a variety of rewards programs, including travel rewards, points, etc. |

| Its foreign transaction fees range from 0% to 1%, depending on the issuer. | Its foreign transaction fees range from 0% to 3%, depending on the issuer. |

| Visa offers multiple security features, including Visa Card Checkout, Verified by Visa, and Visa Card Token Service. | Mastercard offers several security features, including Mastercard SecureCode, Identity Check, and tokenization. |

| Visa card is accepted at more locations worldwide than Mastercard. | Mastercard is widely accepted at most locations that accept credit cards but has slightly less acceptance than Visa. |

- Difference Between Debit and Credit Card

- Difference Between Commercial and Merchant Bank

- Difference Between Central and Commercial Bank

What is a Visa card?

Visa Card is a payment processing company that operates globally. It was founded in 1958 and is headquartered in Foster City, California. Visa card provides a variety of financial services, including credit and debit card transactions, prepaid cards, and mobile payments.

Visa is widely accepted and has over 3 billion cards in circulation. It has partnerships with banks and financial institutions all over the world, which enables Visa cardholders to access their funds easily. Visa offers various types of cards, including traditional credit cards, debit cards, prepaid cards, and corporate cards.

Pros of Visa Card

Here are the three best advantages of using a visa card.

- Global Acceptance – Visa is accepted in over 210 countries, making it a convenient option for travelers.

- Rewards Programs – Many Visa cards come with rewards programs, such as cashback, miles, and points, that allow cardholders to earn rewards for their spending.

- Fraud Protection – Visa offers comprehensive fraud protection, including 24/7 fraud monitoring and zero liability for unauthorized transactions.

Cons of Visa Card

The two disadvantages of a visa card are as follows.

- Fees – Visa cards often come with annual fees, foreign transaction fees, and cash advance fees, which can add up and make the card expensive to use.

- Interest Rates – Visa cards can have high-interest rates, particularly for those with low credit scores or who carry a balance.

What is Mastercard?

Mastercard is a payment processing company that provides financial services to banks and financial institutions worldwide. It was founded in 1966 and is headquartered in Purchase, New York. Mastercard offers a range of payment products and services, including credit and debit card transactions, prepaid cards, and mobile payments.

Mastercard is a popular payment method and has over 2.5 billion cards in circulation. It has partnerships with banks and financial institutions in over 200 countries, making it a convenient option for travelers. Mastercard offers various types of cards, including traditional credit cards, debit cards, and prepaid cards.

Pros of MasterCard

- Widely Accepted – Mastercard is also accepted in over 200 countries, making it a convenient option for travelers.

- Convenience – Mastercard offers a range of digital payment options, including contactless payments and mobile payments, which make it easy for consumers to make purchases without cash or physical cards.

- Credit-building Potential – Using a Mastercard credit card responsibly can help consumers build their credit score over time, which can be beneficial when applying for loans or other financial products.

Cons of MasterCard

The two disadvantages of using a MasterCard are as follows.

- Potential for Debt – Using a credit card, including a Mastercard, can lead to overspending and accumulating debt if not used responsibly.

- Limited Benefits – Some Mastercard cards may offer limited benefits compared to other types of credit cards, such as lower cashback or fewer rewards programs.

Key Differences Between Visa and Mastercard

While comparing both visa and MasterCard, here we have included some of the key differences between them.

- Acceptance – Visa is accepted at more locations globally, while Mastercard has a slightly smaller acceptance network but tends to be more widely accepted in Europe.

- Card Benefits – Visa and Mastercard can offer different benefits and perks to cardholders. For instance, some Visa cards may offer rental car insurance or extended warranty coverage, while certain Mastercard cards may offer price protection or airport lounge access.

Security Features of Visa and Mastercard

Both Visa and Mastercard offer advanced security features to protect their cardholders from fraud. Some of the security features and concerns of both brands include:

EMV Chip Technology: Both Visa and Mastercard use EMV (Europay, Mastercard, and Visa) chip technology, which provides advanced security features to protect against fraud. EMV chips generate unique transaction codes for each transaction, making it harder for fraudsters to replicate or steal card information.

Tokenization: Both Visa and Mastercard also use tokenization, a technology that replaces sensitive card data with a unique token. This token can be used for payment without revealing the card information, making it a safer option for online transactions.

Biometric Authentication: Mastercard offers biometric authentication features, such as fingerprint and facial recognition, to enhance security and prevent fraud.

However, despite these security features, there are still concerns about credit card fraud. Cardholders should be cautious when using their cards and ensure that they keep their cards secure and their PINs and passwords confidential.

Similarities between Visa and Mastercard

Although Visa Card and MasterCard differ in many features, there are some similarities between them as well, given as follows.

- Global Acceptance: Both Visa and Mastercard are accepted in over 200 countries, making them a convenient payment option for travelers.

- Rewards Programs: Both Visa and Mastercard offer a range of rewards programs, such as cashback, miles, and points, that allow cardholders to earn rewards for their spending.

- Advanced Security Features: Both Visa Card and Mastercard offer advanced security features, such as EMV chip technology and tokenization, to protect cardholders from fraud.

Conclusion

So to wrap up this article, we can say that Visa and Mastercard are two of the most popular payment methods in the world. While there are some differences between them, such as the fees and benefits of their cards, they share many similarities, such as their global acceptance and rewards programs. Both Visa and Mastercard offer advanced security features to protect their cardholders from fraud, but it’s important for cardholders to be cautious when using their cards and keep their information secure.