Difference Between Marginal Costing And Absorption Costing(With Table)

Marginal costing is a direct, variable costing process of calculating the cost for each unit produced. Absorption costing is a process of calculating the total cost for the product based on its fixed and variable costs. The following topics will help us understand the complete difference between these two terms.

What is a Marginal Costing?

Marginal costing is a costing system that only takes into account the variable costs when calculating the cost of production. This means that only the direct costs associated with producing a good or service are included in the calculation. Fixed costs, such as rent or insurance, are not included. This type of costing is often used by businesses when making pricing decisions, as it provides a more accurate picture of the true cost of production.

What is an Absorption Costing?

Absorption costing, on the other hand, takes into account all of the costs associated with production, including fixed costs. This type of costing can be useful for decision-making purposes, as it provides a more comprehensive view of the total cost of production. However, it can also lead to higher costs being assigned to products than would be the case under a marginal costing system.

In other words, absorption costing is a method of allocating fixed costs to inventory. This means that the total cost of producing a widget includes the cost of the materials, the cost of the labor, and a portion of the overhead costs. The amount of overhead allocated to each widget is based on the number of widgets produced.

The goal of absorption costing is to create a full picture of the true costs of production. This information can be used by managers to make informed decisions about pricing, production levels, and other factors that affect the bottom line.

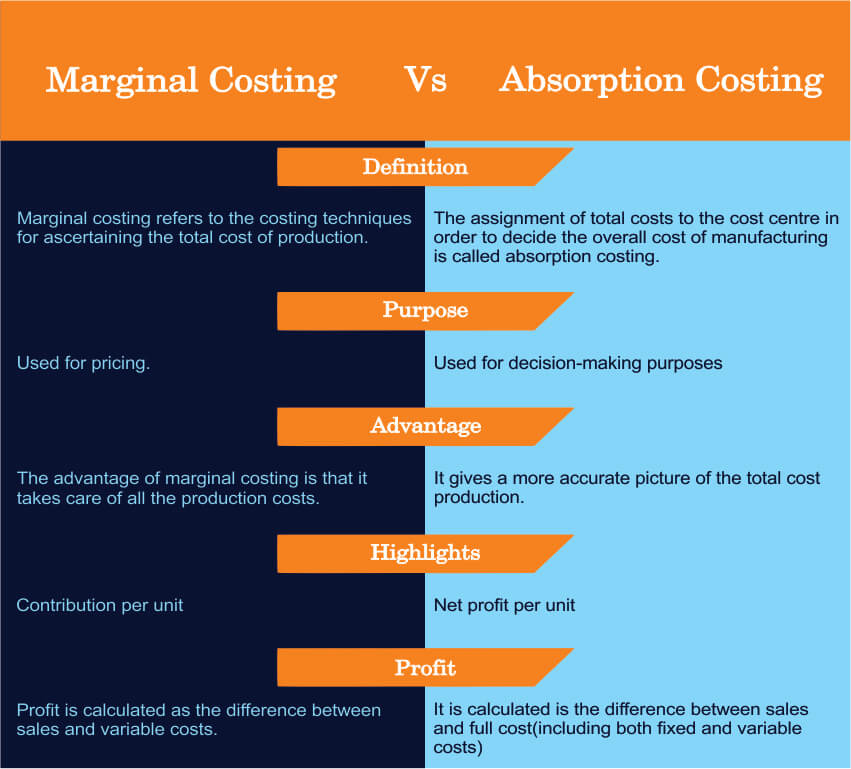

Marginal Costing Vs Absorption Costing(Table)

The following table briefly compares both marginal and absorption costing

Key Differences Between Marginal Costing And Absorption Costing

When it comes to marginal costing and absorption costing, there are a few key things that you need to know in order to understand the difference between the two.

- Marginal costing is a method of accounting that only includes direct costs in the cost of goods sold (COGS). This means that indirect costs, like overhead, are not included in the COGS. On the other hand, Absorption costing is a method of accounting that includes both direct and indirect costs in the COGS. This means that overhead is included in the calculation.

- The advantage of marginal costing is that it’s simpler and easier to calculate. On the other hand, The advantage of absorption costing is that it gives a more accurate picture of the total cost of production.

- The downside of marginal costing is that it doesn’t give a true picture of the total cost of production. On the other hand, the downside of absorption costing is that it’s more complex and can be more difficult to calculate.

- Marginal costing is a technique that only considers the variable costs when coming up with the cost of goods sold. On the other hand, absorption costing includes both variable and fixed costs when calculating the cost of goods sold.

- With marginal costing, inventory is valued at a lower cost or market value. On contrary, with absorption costing, inventory is valued at cost. This means that there can be a big difference in the bottom line when it comes to these two methods.

- Finally, it’s important to understand that marginal costing is typically used in short-term decision-making while absorption costing is used in long-term decision-making. This is because marginal costing doesn’t take into account all of the costs associated with production while absorption costing does.

Conclusion

The main distinction between marginal costing and absorption costing is that marginal costing only considers variable costs while absorption costing includes both fixed and variable costs.

Absorption costing can be contrasted with marginal costing, which only includes variable costs in the cost of goods sold. For some businesses, marginal costing may provide a more accurate portrayal of production costs. However, absorption costing is generally required for financial reporting purposes.

Which costing method is better? It depends on your business goals and objectives. If you need to know the full cost of production for decision-making purposes, absorption costing is the way to go. If you’re only concerned with short-term profitability, marginal costing may give you a more accurate picture. So we hope that you have understood how marginal and absorption costing differ from each other.

One Comment