Intraday trading refers to the form of trading in which the trader buys and sells stocks on the same day. It is also known as day trading or swing trading. On the other hand, delivery trading is another strategy where the position is opened and closed at the end of an allotted time. This was a brief introduction to these two terms. Now in order to understand the core difference between intraday and delivery trading, let’s have a look at the following set of concepts.

You Can Also Read: Difference Between Trading and Investing

What Is Intraday Trading?

In the business and financial world, Intraday trading refers to the act of buying and selling a security/stock within the same day. In other words, a buy and sell order executed on the same day can be considered an intraday trade. Moreover, in order to participate in intraday trading, an online trading account must be set up with special intraday trading orders. Before the trading day concludes, these orders are squared off.

The Securities and Exchange Commission (SEC) has specific rules concerning intraday trading. These rules are designed to protect investors from making impulsive decisions that could lead to losses. For example, the SEC requires that investors receive real-time price quotes for all securities before making an intraday trade.

Example Of Intraday Trading: Suppose you buy shares of XYZ stock at 10:00 a.m. and sell them at 2:00 p.m., you have completed an intraday trade.

Advantages Of Intraday Trading

There are many advantages of intraday trading but here we have described three of the main ones.

- One of the main benefits of intraday trading is that you can take advantage of short-term price movements.

- You can make a profit even when the overall market is down. If you are able to identify a stock that is undervalued, you can buy the stock and hold it until the market turns around. This can be a great way to make a profit even when the market is down.

- The trader only needs a minimum capital commitment because payments can be made in small margins.

Disadvantages Of Intraday Trading

Intraday trading can also be risky. It is important to understand the risks before you begin trading. Here we have mentioned four disadvantages of intraday trading.

- Risk – Because the amount necessary for intraday trading is less than that required for delivery, investors are over-exposed to risk, and any bad move might wipe out the entire money.

- Higher Loss – Ignoring real expectations may lead to higher loses

- Constant Attention – Intraday trading requires a trader’s constant attention

- Loss of Long-Term Profit Chance – You may miss out on long-term profit chances if you try to enter and exit positions in day trading.

- Required Quick Decisions – When you are doing intraday trade, you have to make your decision quickly and there is always a risk of losing money if the market fluctuates.

You Can Also Read: Difference Between Trading Vs Investing

What Is Delivery Trading?

Delivery trading is another form of trading in which an investor purchases stocks on a trading day and then sells them at a later date. This means that in delivery trading, the buyer receives delivery of the stocks rather than settling their position during the same trading session.

In delivery trade, you buy the shares and hold them for a certain period of time before selling them. The time period can be anything from a few days to months or even years. Since you are holding on to the shares for a longer period of time, there is less risk involved.

Five Advantages Of Delivery Trade

There might be many advantages of delivery trading. But in this article, we have described five of the major benefits of delivery trading, given as follows.

- You Can Earn More Profit – If you are looking to earn more profit from your trade, then delivery trade is the best option for you. This is because you can hold on to your stock for a longer period of time and sell it when the price is right.

- You Have More Control Over Your Trade – With delivery trade, you have more time to think about your decision and you can also set a stop-loss so that you don’t lose all your money if the market crashes.

- You Can Use It As Collateral – If you are taking a loan from a bank or financial institution, then you can use your stocks as collateral. This will help you get a lower interest rate on your loan.

- It Is Less Risky – Delivery trade is less risky as compared to intraday trade. This is because you are not exposed to market fluctuations for a long period of time.

- Bonuses – Since you won the stock, you will be able to earn all of the benefits in the delivery trade. You can even claim bonus shares if the corporation issues them.

Three Disadvantages Of Delivery Trading

- More brokerage Charges – Another downside of delivery trading is that brokerage fees are greater. When you visit a stockbroker, intraday trading may be significantly cheaper than delivery trading.

- You can’t square off your position before the market closes – Suppose you want to square off your position before the market closing time, you can’t do it in Delivery trading. So, you need to wait till the market closes.

- Can’t use intraday techniques – Intraday techniques like Scalping and day trading are not allowed in Delivery trading.

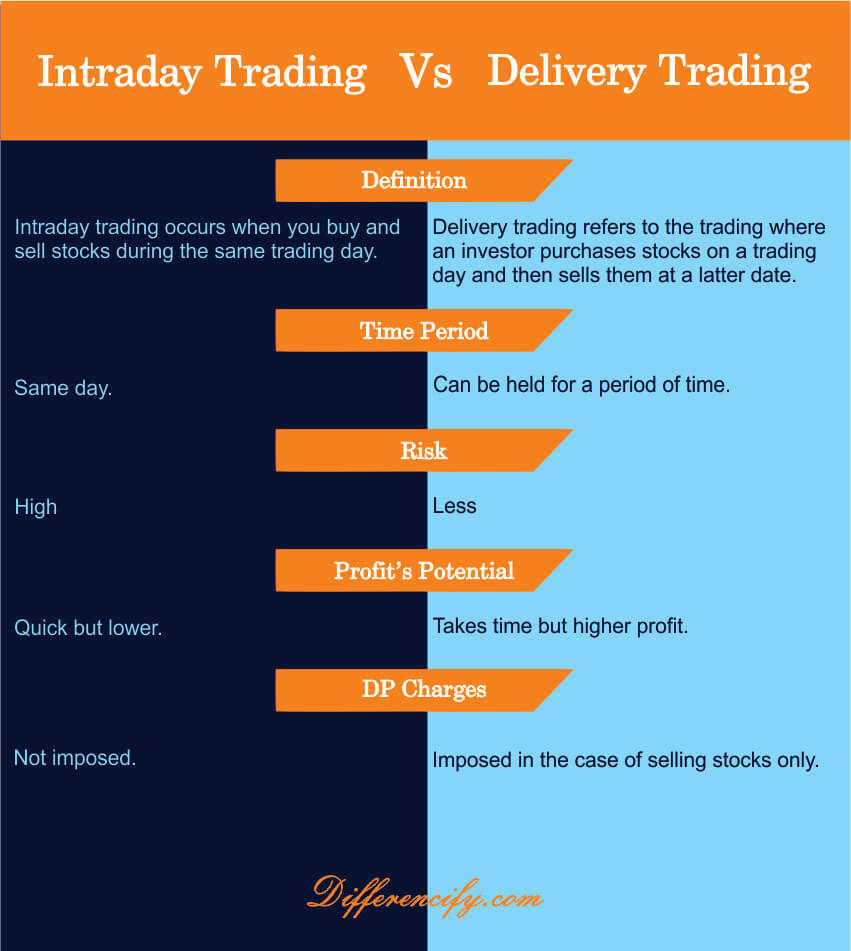

Intraday Vs Delivery Trading – Main Difference

The main difference between intraday and delivery trading is that in intraday trading, the trader buys and sells shares within the same day, while in delivery trading, the trader can hold the shares for a period of time before selling them.

Intraday trading is considered to be riskier than delivery trading as there is a chance that the prices of the shares may change significantly within the day. Delivery trading, on the other hand, allows the trader to wait for the right moment to sell the shares and make a profit.

Intraday Vs Delivery Trading(Comparison Table)

Key Differences Between Intraday And Delivery Trading

- Intraday trading involves buying and selling shares within the same day. Delivery trading, on the other hand, involves holding shares overnight.

- Intraday trading is generally considered to be riskier than delivery trading because you’re dealing with a shorter time frame and there’s more potential for things to go wrong.

- Delivery trading generally requires a higher initial investment than intraday trading. This is because you’re buying more shares upfront and also because you’re taking on more risk by holding them overnight.

- For intraday trading, stock brokers provide high leverage or margin. This means that investors can use the leverage option to purchase more shares than the amount in their account. In the event of delivery, the investor must pay in full in advance. This signifies that the delivery trade is settled in cash. Only when the account balance is sufficient may the investor purchase shares.

- Intraday traders need to be aware of the daily price limits that are set by exchanges. These limits prevent stocks from moving too far up or down in a single day, which can create difficulties for intraday traders.

- Intraday trading requires more active management than delivery trading. This is because you need to constantly monitor the markets and make decisions about when to buy and sell shares.

Conclusion

So, we can conclude that the main difference between intraday and delivery trading is that with intraday trading, all positions are closed before the end of the day’s trading session, while with delivery trading, some positions may be carried over to the next day. We hope that this article was helpful for our readers.

One Comment